Industry Insight | Uzbekistan's PV Market: A Promising Central Asian Frontier for Steady Growth

Date:

2025-04-11 16:12

As a key player in Central Asia, Uzbekistan is stepping into a phase of rapid growth for its photovoltaic (PV) market. Blessed with abundant solar resources, stable economic progress, and strong government commitment to renewable energy, the country offers immense potential for PV development. This market not only addresses local electricity shortages but also presents lucrative opportunities for investors.

01 Market Status and Prospects: A Promising Central Asian PV Horizon

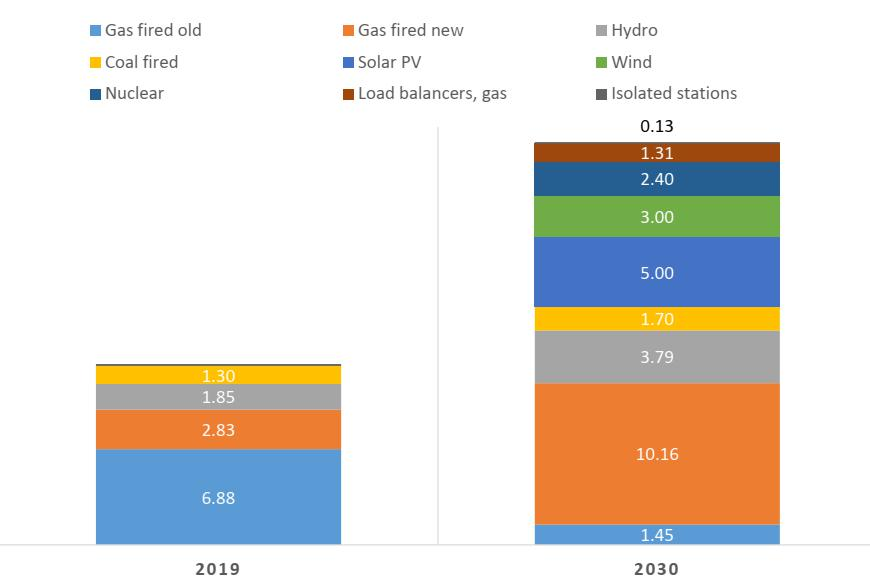

Nestled in Central Asia, Uzbekistan boasts exceptional solar potential with an annual average of 3,000 sunshine hours, ranking it among the world’s most promising PV markets. Driven by global demand for renewables, its PV sector has gained notable momentum. As of 2024, installed PV capacity stands at around 5GW. Under the national energy plan, renewables are set to account for 54% of the energy mix by 2030, signaling significant market expansion.

The Ministry of Energy of the Republic of Uzbekistan released its Energy Plan for 2020–2030.

(Data source:Renewable Energy in Uzbekistan,

Bekzod Asadov, Ministry of Energy,

Republic of Uzbekistan Tashkent 2021)

However, the market remains small and penetration low. In 2023, new PV installations totaled just 410 MW, trailing peers like Kazakhstan (over 1GW). Still in its infancy, the market is poised for rapid growth as policy support and infrastructure improve. A landmark initiative includes 18 solar and wind plants with 3,400 MW of capacity, paired with 1,800 MW of energy storage, aiming to boost annual green energy output to 12 billion kWh—marking Central Asia’s rise as a global renewables hub.

02 Electricity Prices and Supply Challenges: PV as a Solution to Unreliable Grids

Uzbekistan’s low electricity prices—industrial rates at ~$0.07/kWh and residential at $0.017–$0.07/kWh—belie chronic supply issues. Frequent outages during summer/winter peaks disrupt businesses and households, particularly high-energy industries facing production losses and steep costs. Here, PV+storage systems shine: they stabilize supply for energy-intensive enterprises and slash costs. In Tashkent, factories using such systems report 30–40% annual savings on electricity bills.

The government’s “self-consumption with surplus feed-in” policy further accelerates adoption, allowing users to sell excess power to the grid. This model is a catalyst for broader PV market growth.

03 Policy Drivers: Fostering Commercial and Industrial PV-Storage Adoption

Uzbekistan’s government has prioritized PV through robust policies, especially for commercial and industrial sectors. The 2019 Renewable Energy Law provides a legal framework, offering tax incentives, subsidies, and duty-free imports of PV components since 2020, reducing upfront costs significantly.

Uzbekenergo streamlines grid connection processes to speed up project implementation, while the Electricity Law ensures quality through government approval and technical standards. Industrial parks and special economic zones receive extra benefits like preferential land access; Tashkent’s PV industrial park, for example, has attracted international investors, fostering innovation and clustering.

Long-term power purchase agreements (PPAs) and partnerships with the World Bank and ADB enhance investor confidence, creating a solid financial foundation. These policies together fuel sustained growth in commercial PV-storage solutions.

04 Competitive Landscape: International Leaders and Emerging Local Capacity

While Uzbekistan’s PV industry is young, global players have already made their mark. Companies like UAE’s MASDAR (developing Navoi’s 100MW plant) and Chinese firms LONGi Solar and Jinko Solar lead infrastructure development, bringing technology and capital. The market relies heavily on imported components—modules and inverters from China, Germany, and India—but local manufacturing is expected to grow as the market matures.

Export capabilities are nascent, but a developing local supply chain could position Uzbekistan as a regional PV exporter, unlocking broader Central Asian potential.

05 Dual Growth Engines: Foreign Technology and Local Demand

Crystalline silicon modules dominate the market, benefiting from efficiency gains and cost reductions via scale. Though local R&D is limited, partnerships with international firms inject advanced technologies. Rising industrialization drives electricity demand, making PV—a low-carbon, cost-effective solution—popular with both the government and businesses. Rural areas see PV as a vital tool for energy access.

Currently focused on large-scale centralized projects, distributed PV is emerging. Diverse demand and policy support are set to propel its growth, adding a new engine to the market.

06 Investment Strategy: Prudent Quality and Risk Management

While the outlook is bright, challenges persist: grid upgrades are needed for large-scale PV integration, and immature market standards mean variable product and construction quality. Investors must prioritize due diligence—selecting reliable equipment, partners, and adopting “payment-first” models to mitigate financial risks.

Tashkent and economic zones, where PV+storage demand is surging in industrial parks and high-energy facilities, offer prime opportunities. As policies deepen, the market will enter a rapid growth phase, rewarding those who balance ambition with operational rigor.

Conclusion

Uzbekistan’s PV market combines abundant solar resources, proactive policies, and rising energy demand, creating an ideal investment climate. Though small today, steady, quality-focused expansion—especially in PV-storage and self-consumption models—promises stable returns. For investors, this Central Asian frontier is a compelling bet, requiring careful assessment of scale and risk to capitalize on its transformative potential.

Prev

Prev

Jiangsu Juncess Energy Co., Ltd

Office Add: Room 299, Floor 2, Building 1, Xinghai Building, No. 198 Xinghai Street,

Suzhou Industrial Park, Suzhou Area, China (Jiangsu) Pilot Free Trade Zone

Factory Add: No.801, Huagang Road, Wujiang District, Suzhou, Jiangsu, China