Industry Insight | Power Crises in Multiple Middle Eastern Countries Boost Solar and Energy Storage Demand

Date:

2025-03-31 16:24

Monitoring by observers shows recent severe power crises across multiple Middle Eastern countries, with frequent outages crippling production and daily life. To alleviate these shortages, governments are accelerating the promotion of solar power and energy storage solutions.

Iran

Since last summer, Iran has been mired in a severe electricity crisis. During peak demand days in 2024, the country faced an average power deficit of 20,000 megawatts, a gap projected to climb to 25,000 megawatts this summer.

Despite vast oil and gas reserves, sanctions have blocked investment and equipment imports, compounded by Israeli sabotage of gas pipelines, Bitcoin mining surges, and climate change impacts—leading to widespread outages nationwide.

Last month, Iran secured a 3.897 billion RMB loan from China to build 1.7GW of solar power projects across the country. Approved by the Financial Budget Organization, the electricity sector will repay the loan through green energy sales and power exports, avoiding additional fiscal burdens.

Iran is now speeding up imports of PV modules and inverters. Media reports indicate a deal with China to barter crude oil for equipment.

President Masoud Pezeshkian has ordered all government agencies to install solar panels by this summer to address shortages. The government will roll out smart meters, phase out inefficient equipment, and mobilize public energy-saving campaigns.

Iraq

A 120-day sanctions waiver issued by former U.S. President Joe Biden, allowing Iraq to import gas and electricity from Iran, expired on March 8, 2025—triggering an impending power shortfall.

Despite abundant oil and gas resources, decades of war, corruption, and mismanagement have left Iraq dependent on imported Iranian gas and direct electricity imports to meet demand.

Economist Al-Marsoumi warns that domestic gas production cannot replace Iranian imports, solar projects will take three years to complete, Kuwait’s 500MW supply won’t arrive until 2026, and Turkey’s 600MW transmission plan still awaits EU approval. Power shortages are expected to persist through the 2025 summer.

Kuwait

While sitting on 6% of the world’s oil reserves, Kuwait’s power infrastructure has lagged far behind surging demand, causing frequent summer outages.

Recently, Kuwait’s Ministry of Electricity advisor Al-Muneefi warned of a 1,600MW deficit in summer 2025, projected to expand to 5,600MW by 2029.

The country plans to expand existing power plants and build new facilities, aiming to boost renewable energy to 30% of its mix within four years. Bloomberg reported that last month, Kuwait signed a contract with China to develop Mubarak Al-Kabeer Port, followed by a new framework agreement to expand the Al-Shagaya and Al-Abdiliya solar plants.

Syria

Fourteen years of civil war and Western sanctions on the Bashar al-Assad regime severely devastated Syria’s economy and infrastructure. Better-off households and businesses rely on solar panels and private generators, while most others endure near-constant outages. Since the Assad regime fell in December 2024, the country now receives just 1–2 hours of daily grid power. The interim government faces massive reconstruction challenges, with the new electricity minister planning to boost generation capacity to 12,000 megawatts within five years.

On March 12, the U.S. approved Qatar to supply Syria with natural gas, expected to generate 400 megawatts daily and double state-provided power from two hours to four hours, according to interim Electricity Minister Omar Shakrouk.

Gaza Strip, Palestine

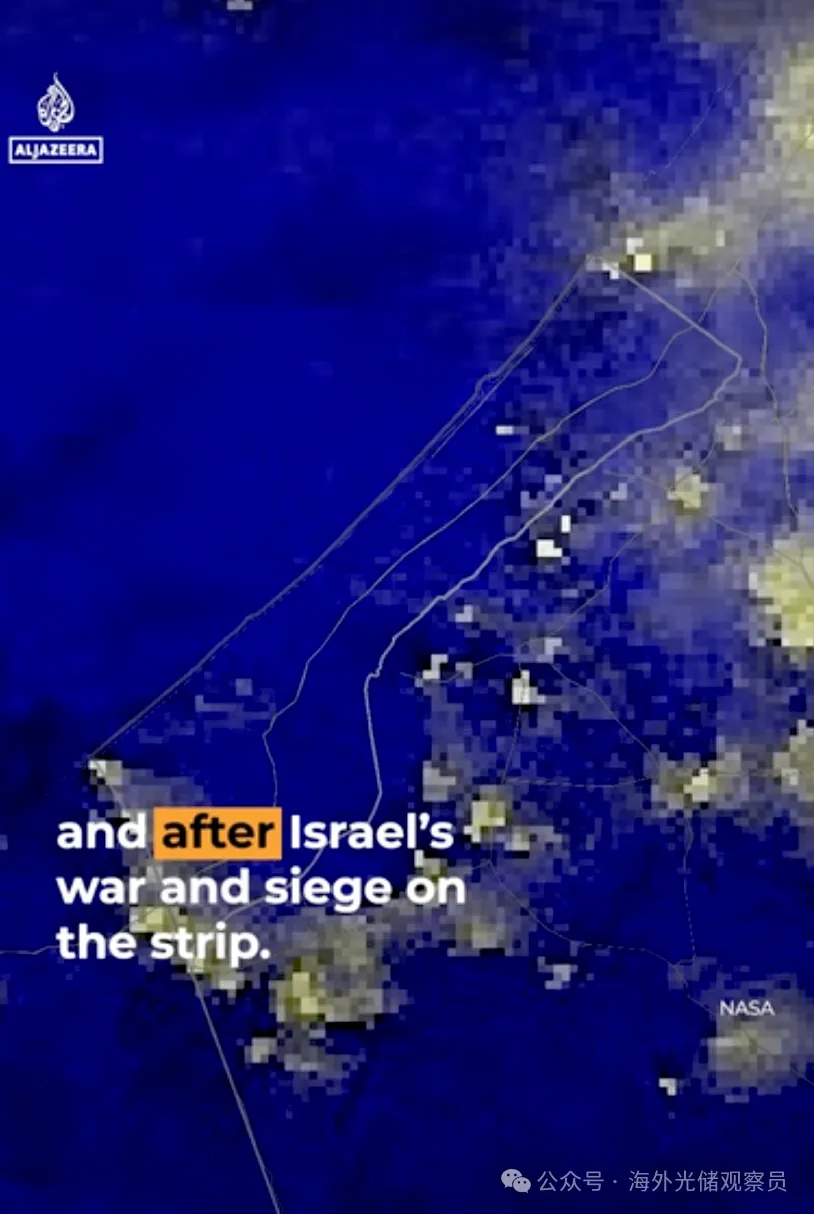

Israel formally cut off electricity to the Gaza Strip on March 9, 2025, after sustained bombing of its sole power plant and destruction of infrastructure, worsening the post-conflict humanitarian crisis and plunging residents into deeper hardship.

Satellite imagery depicts the strip engulfed in darkness following the outage, highlighting the dire living conditions.

Jiangsu Juncess Energy Co., Ltd

Office Add: Room 299, Floor 2, Building 1, Xinghai Building, No. 198 Xinghai Street,

Suzhou Industrial Park, Suzhou Area, China (Jiangsu) Pilot Free Trade Zone

Factory Add: No.801, Huagang Road, Wujiang District, Suzhou, Jiangsu, China